GCash To Launch Face Recognition Feature

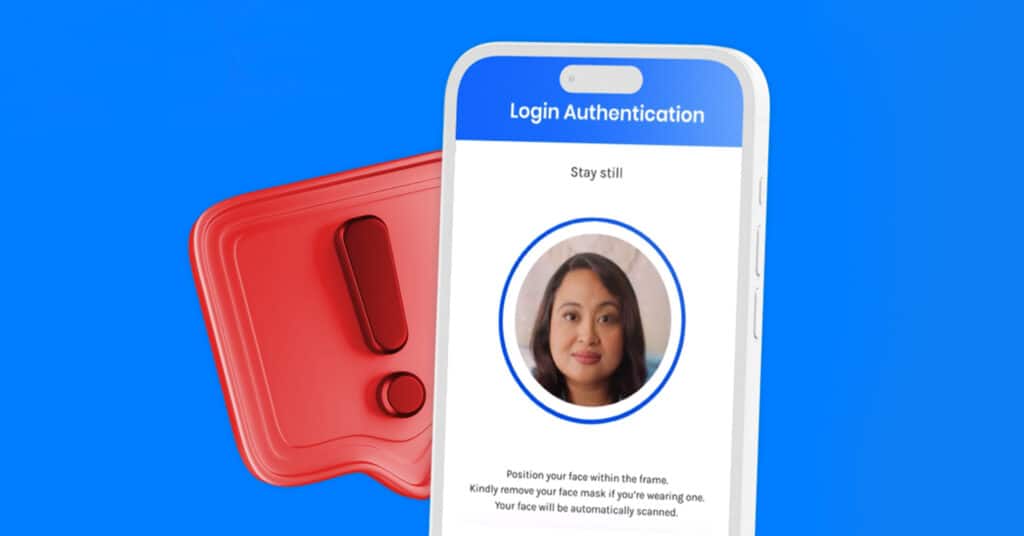

The most recent security feature from GCash, the top mobile wallet in the Philippines, is the “DoubleSafe” Face ID. This ground-breaking innovation attempts to guard against fraudulent transactions and improve user security. In order to give its users an additional degree of security, even if their PIN is hacked, GCash uses face recognition technology and liveness detection.

For all verified GCash customers, the DoubleSafe Face ID functionality is being made available. In spite of any potential PIN compromises, it uses cutting-edge facial recognition algorithms and liveness detection technologies to make sure that only the account owner can access their GCash account.

Face Recognition Technology for Enhanced Security

Recent years have seen a rise in the use of face recognition technology, which has revolutionized many industries, including mobile payments and banking. Face recognition technology is being used by GCash to considerably increase security measures while allowing users to access their accounts conveniently.

The DoubleSafe Face ID function of GCash goes beyond simple face recognition. It has a liveness recognition feature that stops unwanted access via images or videos. It is quite challenging for fraudsters to go around the system because of this additional degree of protection, which assures that the user’s real presence is essential to prove their identity.

How to Use DoubleSafe Face ID

Users must go through a setup process for face recognition when they choose to utilize the DoubleSafe Face ID function. GCash records and safely saves an encrypted image of the user’s facial biometrics during this process. Future authentication attempts use this encrypted data.

The user only needs to look into their mobile device’s front camera to access their GCash account. The very accurate facial recognition algorithms compare the real-time facial image to the encrypted biometric data that has been saved before deciding whether to give access.

Convenience and simplicity: Users may easily access their GCash accounts with DoubleSafe Face ID by simply looking into their device’s front camera. The entire user experience is improved because this simplified procedure eliminates the need to memorize and enter PINs.

Heightened Security: GCash greatly enhances security measures by combining face recognition technology and liveness detection. Unauthorized access becomes very difficult even if a user’s PIN is stolen because the fraudster would need the user’s physical presence in order to successfully authenticate.

Unauthorized Transaction Prevention: DoubleSafe Face ID effectively thwarts unauthorized transactions. The function adds an additional degree of security, lowering the danger of fraudulent activity by guaranteeing that only the registered user may access their GCash account.

The DoubleSafe Face ID function that GCash has added is a significant step toward boosting security protocols for mobile banking and payments. In order to give its consumers a seamless and safe experience, GCash makes use of liveness detection and face recognition technology. Integrating cutting-edge security features, like DoubleSafe Face ID, is essential for protecting user accounts and preserving confidence in the digital financial ecosystem as fraudulent actions continue to evolve.